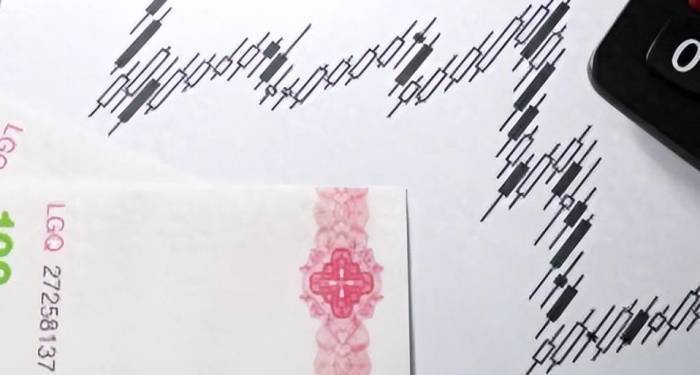

The financial landscape in the United States is marked by fluctuations, and on November 27, the three major indexes displayed a collective decline. The Dow Jones Industrial Average dropped by 0.31%, the Nasdaq fell by 0.60%, and the S&P 500 lost 0.38% of its value. This setback came at a time when the broader market appeared to be reaching new heights, creating an unsettling feeling among investors who were eagerly looking to capitalize on the positive momentum.

Tech stocks, particularly from the sector dubbed the “Seven Sisters,” experienced heavy losses. Iconic firm Tesla saw its shares decrease by 1.58%. Google’s parent company Alphabet witnessed a minor uptick of 0.07% in its A shares, while Apple managed to lose a mere 0.06%. Meta Platforms (formerly Facebook) declined by 0.76%, and Amazon's stock fell by 1.02%. Notably, Nvidia showed severe volatility, at one point falling over 3.5%, settling with a reduction of 1.15% at the close of trading.

Meanwhile, Microsoft endured a drop of 1.17% due to an antitrust investigation launched by the Federal Trade Commission (FTC). This inquiry encompasses various aspects related to cloud computing, software licensing, cybersecurity products, and artificial intelligence technologies. Reports suggest that following extensive informal discussions with competitors and business partners over a year, the FTC has moved forward with a comprehensive request intended to compel Microsoft to provide extensive information on its business practices. Insiders note that this extensive request—hundreds of pages long—has been sent to Microsoft after gaining approval from Chair Lina Khan. Furthermore, it has been revealed that the FTC’s antitrust attorneys will meet with Microsoft's competitors shortly to collect additional insights regarding the company’s business conduct.

Chipmakers also saw a downturn, with Micron Technology and Broadcom both experiencing drops exceeding 3%. The stock of Arm slipped over 2%, while industry giants Nvidia, Intel, AMD, and TSMC all faced declines greater than 1%. This trend within the semiconductor sector raises concerns about the industry's recovery trajectory, especially given the increasing global demand for high-performance chips.

On the evening of November 27, after the opening bell rang on Wall Street, two prominent computer manufacturers, Dell Technologies and HP, saw their stock prices plummet. The disappointing financial results released by both companies led to investor disenchantment, particularly among those hoping for a resurgence in the personal computer market. Dell reported a revenue decline of 1% to $12.1 billion for its PC business in the third quarter of the fiscal year, marking a figure that fell short of market expectations. In contrast, HP's personal computer sales did see a 2% increase, reaching $9.59 billion, but once again failed to meet the average forecasts laid out by analysts.

As the crypto market displayed signs of resilience, Bitcoin surged back above $97,000, illustrating the volatility and allure of digital currencies. Stocks connected with the cryptocurrency sector rallied, with Bit Digital climbing over 18%, Riot Platforms nearly 11%, MicroStrategy approaching 10%, and Coinbase rising over 6%. This activity demonstrates the continued interest in digital assets, even as traditional market indicators fluctuate.

Moreover, Dell's substantial drop of over 12% due to disappointing third-quarter revenues and cautious fourth-quarter guidance reflects the challenges facing tech companies as they navigate a rapidly evolving consumer landscape.

In the commodities realm, January WTI crude oil futures settled down by $0.05 to close at $68.72 per barrel, registering a minimal decline of 0.07%. In contrast, Brent crude oil futures for January saw a slight appreciation of $0.02, finishing at $72.83 per barrel, while NYMEX January natural gas futures plummeted by 7.58%, settling at $3.2040 per million British thermal units. These price movements highlight the ongoing volatility within the energy markets, influenced by global supply chain intricacies and geopolitical considerations.

In an unexpected twist, amidst the backdrop of U.S. stocks routinely hitting new historical highs, JPMorgan Chase decided to abandon its previously pessimistic outlook for the S&P 500 index. Chief Global Equity Strategist Dubravko Lakos-Bujas communicated to clients that JPMorgan's new 2025 target for the index is set at 6,500, representing a remarkable 55% increase from past forecasts dated at 4,200, thus suggesting a potential upside of approximately 8% from the index's Tuesday closing value of 6,021.63.

It's noteworthy that prior to this, JPMorgan had held a bearish perspective on the S&P 500 for two consecutive years. Meanwhile, Goldman Sachs strategists pointed to high concentration and valuation metrics as reasons for reducing the weighting of U.S. equities in diversified portfolios. They recommended a focus on Asian stocks, short-term U.S. government bonds, and the U.S. dollar, asserting that gold remains the premier tool for hedging against market volatility.

Goldman Sachs characterized the forthcoming year as the “Year of Alpha,” advocating investors to prioritize diversification in the face of markedly high market concentration in an effort to elevate risk-adjusted returns. This perspective underscores an evolving investment strategy that caters to changing economic dynamics.

On the evening of November 27, a series of significant economic reports emerged from the U.S., impacting market variables significantly. The core inflation metric favored by the Federal Reserve accelerated in October, shedding light on why policymakers have adopted a more restrained approach to interest rate cuts. According to data released by the U.S. Bureau of Economic Analysis on the same day, the core personal consumption expenditures (PCE) price index, which excludes volatile food and energy prices, rose by 2.8% year-on-year in October, reflecting a 0.3% increase month-over-month.

Consumer spending adjusted for inflation displayed a modest rise of just 0.1% in October, following a revised 0.5% increase in September. This aligns with the broader trend of uneven demand patterns observed throughout the year. Such data bolster the opinions of numerous Federal Reserve officials who argue that there are no pressing needs for a rapid interest rate cut as long as the labor market remains robust and economic recoveries continue.

Although inflation is receding towards the Federal Reserve's target of 2%, the path ahead may become increasingly complex depending on the evolving economic agenda. Rising service prices largely account for the current uptick in inflation. The core services prices, excluding housing and energy—categories prioritized by the Fed—saw a rise of 0.4%, the largest increase since March. In contrast, core goods prices remained stable.

Furthermore, another governmental report indicated that the U.S. GDP growth for the third quarter was unrevised at 2.8%, bolstered by consistent consumer and business spending. Analysts noted that while growth rates have moderated recently, the U.S. economy has enjoyed eight out of the last nine quarters with growth rates surpassing 2%, showcasing a continued resilience amidst various challenges.

Earlier on November 27, the U.S. Labor Department revealed that initial jobless claims fell below expectations and matched prior values, reinforcing the steadiness of the U.S. labor market. Data indicated that during the week ending November 23, the number of first-time applicants for unemployment benefits stood at 213,000, slightly under the anticipated figure of 215,000. Previous numbers were adjusted from 213,000 to 215,000.

The continuing claims for unemployment benefits reached 1.907 million, marginally below the projected 1.908 million, yet still representing the highest level since November 2021. This suggests that many unemployed workers are struggling to secure new employment. The rise in continuing unemployment claims has raised eyebrows, reaching peaks not seen since late 2021, which may signal shifts in the U.S. employment market. The increase in this metric reflects the persistence of long-term unemployment issues, contrasting with the low levels of initial claims, indicating potential challenges ahead for the employment landscape.

Comments (0)

Leave a Comment